child tax credit portal not working

June 25 2021. Contact the IRS as soon as.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

You can also use the portal to unenroll from receiving the monthly payments if you are not eligible or prefer to receive the full amount of your credit when.

. The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC. The IRS will pay 3600 per child to parents of children up to age five. The third advance child tax credit or CTC started hitting bank accounts Wednesday but some recipients are reporting issues receiving their payments.

Get your advance payments total and number of qualifying children in your online account. Do not use the Child Tax Credit Update Portal for tax filing information. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

And 110000 for joint filers. This will allow you to claim if eligible the missing payment with your Child Tax Credit on your 2021 return. For tax year 2022 the child tax payment reverts to 2000 annually per qualifying child which in.

Throughout 2021 they received 3000 and will claim the other half on their tax return. Visit the IRS website to access the Child Tax Credit Update Portal Go to httpswwwirsgovcredits-deductionschild-tax-credit-update-portal. Most eligible families received up to 300.

The Child Tax Credit Update Portal allows you to verify your familys eligibility for advance payments of this tax credit and add or update a bank account to receive your payments quickly by direct deposit. In 2022 they will file their 2021 return report the amount they received and claim the remaining half of their tax credit 3000. Already claiming Child Tax Credit.

Check mailed to a foreign address. At first glance the steps to request a payment trace can look daunting. The advance payments are half of the total so the couple will receive 500 250 per dependent each month until December.

Youll need to print and mail the. You lose 50 for each 1000 rounding up your income is over that threshold. The IRS is paying 3600 total per child to parents of children up to five years of age.

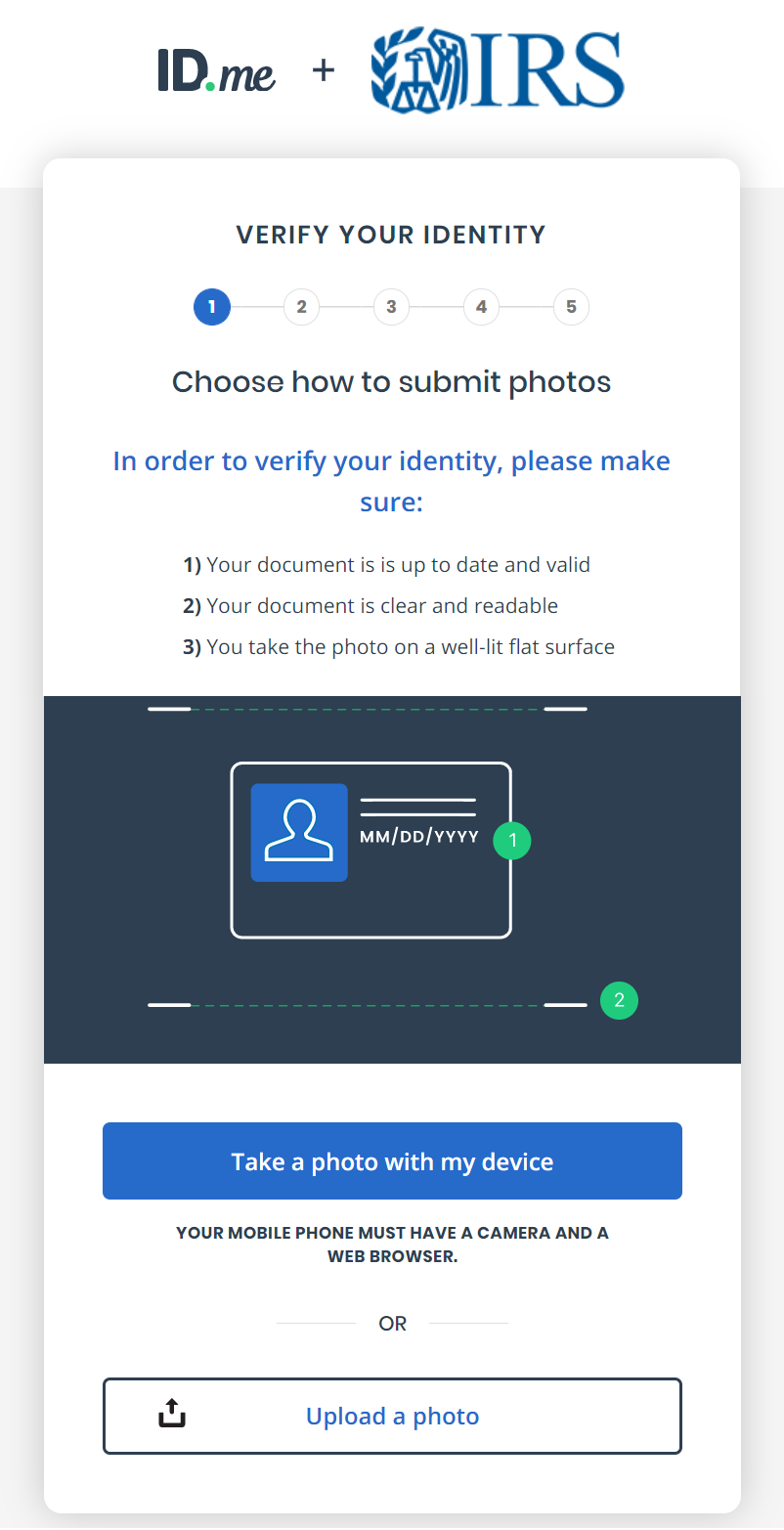

In order to sign in to any of the portals you will need to first verify your identity through IDme. Previously it was 75000 for single head of household and qualifying widow or widower filers. Making a new claim for Child Tax Credit.

The Child Tax Credit Update Portal now issues a warning in bold. For a 10-year-old child the credit was worth 2000 in 2020 which lowered a familys tax bill by that amount when they filed their return Wacek explained. Click the blue Manage Advance Payments button.

13 since the 15th falls on a Sunday Sept. Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021. The amount you can get depends on how many children youve got and whether youre.

The IRS has created specific online portals for updating your personal information and managing the Child Tax Credit payments that began being distributed on July 15. Right now you can change your income in the portal by going to Manage Advance Payments and selecting Report Life Changes Keep in mind that parents of children younger than age 6 can receive up. The Child Tax Credit CTC is phased out at higher incomes starting at 400000 for joint filers 200K single.

To reconcile advance payments on your 2021 return. Enter your information on Schedule 8812 Form. How Does The Advance Child Tax Credit Work.

The IRS has partnered with the third-party company to verify identities. The new Child Tax Credit Update Portal allows parents to view their eligibility view their expected CTC advance payments and if they wish to do so unenroll from receiving advance payments ie to opt out. Contactless payments personal finance cash money.

Half will come as six monthly payments and half as a 2021 tax credit. If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you. And towards the end of this post we will walk through step-by-step what you need in order to.

The IRS plans to issue direct deposits on the 15th of each month. The enhanced portion of the child tax credit program has since lapsed. If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit there can be.

These people can now use the online tool to register for monthly child tax credit payments.

View Or Download The Form 26as New Income Tax E Filing Portal Edutaxtuber Income Tax Income Income Tax Return

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Pin By The Taxtalk On Income Tax In 2021 Capital Gain Capital Assets Investing

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

Quicko Gst Tax Credits Tax Income Tax

Provisional Itc Credit On Gst Portal ज एसट प र टल पर प र व शनल आईट स Tax Credits Portal Credits

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

We Are Organising The E Meeting Google Hangout Meet On Issues In Reconciliation Of Gst Input Tax Credit To Rec Tax Credits Reconciliation Google Hangouts

Tax Compliance Calendar For Fy 2019 20 It Gst Tds Eztax In Filing Taxes Compliance Tax Services

Invoice Registration Portal Process Benefits Mode Of Registering In E Invoicing Portal Government Portal Invoicing Registration